The maritime industry has been facing headwinds for almost a decade now: chronic tonnage oversupply, intermittent demand growth, new trading patterns, heightened level of regulations, new technologies and vessel designs, and more recently, the prospect of a global trade war. It’s not easy being a shipowner, if ever it was.

Besides the obvious “academic” solutions of self-discipline when it comes to newbuilding appetite and accelerated schedule of ship demolitions, little can be done strategically to alleviate the industry’s woes.

Since the early days of the present decade, the concept of consolidation has been mentioned as a solution with the best hope for mitigating the industry’s problems. Conceptually, fewer and bigger owners could better sustain the weak times of the industry by sharing overhead and expenses across larger fleets, by having higher fleet efficiencies, and by affording more competitive access to capital; a market dominated by fewer owners can also employ strategic efficiencies whereby fewer players would be more disciplined at ordering newbuldings and also providing a united front against the demands of charterers.

Notable names of the shipping and the finance worlds have been advocating for industry consolidation for some time now, most conspicuously then-private-equity-shipping-investor and now Commerce Secretary Wilbur Ross. Proponents of consolidation have drawn their conclusions mostly from other industries than shipping, such as the steel industry in the case of Wilbur Ross; and, there is a strong body of academic research and case studies taught at business schools supporting the case of consolidation. On the surface, consolidation has saved the steel industry from chronic losses (although ironically part of the current trade war discussion is driven by the consolidated state of the steel industry having cost thousands of jobs). Likewise, the airline industry, via consolidation (and also chronic waves of bankruptcies), have reached now a point of high utilization and profitability, as any weary traveler can attest to these days.

No doubt there are economic benefits for the players in a market that has undergone consolidation; on the other hand, we think that certain markets and industries are more prone to consolidation than others, for many reasons.

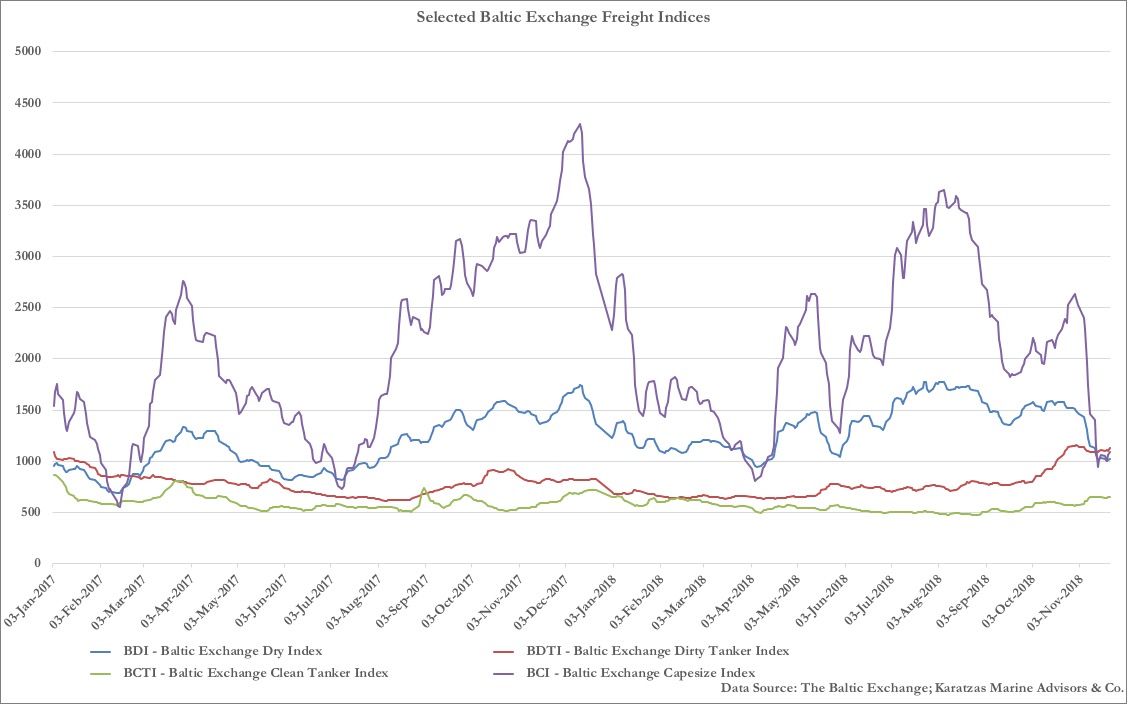

Let’s follow the empirical approach to see what has happened so far in this maritime field:

Wall Street and institutional investors are big proponents for consolidation in the shipping industry. Image credit: Karatzas Images

In the tanker market, after Frontline’s failed effort to acquire DHT, the got critical mass to defend itself by buying the BW VLCC fleet, catalyzing, in turn, Euronav’s acquisition of Gener8 Maritime (itself the product of merger of General Maritime and Navig8 Crude Tankers). There is little merger activity in the rest of the crude tanker market, with the exception of Teekay folding two “daughter” publicly-listed companies into one, and also acquiring the Principal Maritime crude tanker fleet. In the product tanker market, Scorpio Tankers acquired Navig8 Product Tankers in 2017, while recently BW took a bow with publicly listed Hafnia Tankers. If there is a lesson to be learned from merger activity in the tanker industry is that these are a handful of transactions among already sizeable players who are publicly listed and/or driven by institutional investors or financially-oriented managers behind them. The typical, average tanker owner has been least affected, or bothered, at least so far. However one slices the tanker market, there are almost 15,000 tankers of all sizes with a few thousand shipowner groups worldwide; if all these tankers and owners were to be consolidated into groups of big companies, investment bankers in shipping would be among the richest people on this planet.

In the dry bulk market, Star Bulk, publicly listed and driven by institutional investors, have been growing the size of their fleet by acquiring Augustea, Songa Bulk, and Ocean Bulk in the past. Golden Ocean acquired the Quintana capesize-focused fleet, and potentially the acquisition of the CarVal Investors dry bulk fleet by Good Bulk can be considered a case of consolidation; there are a few more meaningful transactions with privately held companies (most the Angelicoussis and Zodiac groups) acquiring massively, and surgically, shipping assets in the secondary market. There is no doubt that there has been much more S&P activity in the dry bulk, but nothing to qualify as consolidation. The dry bulk market is often described as the textbook case of perfect competition, and as such, it makes little sense to buy (and retire) dry bulk shipping companies – the companies have little to offer in excess of the stripped assets. Again, zooming out on the sector, consolidation so far seems to be with mostly sizeable companies, publicly listed, often driven by institutional investors, and almost always payment taking place – at least partially – in shares. There is still a very ‘long tail’ of small shipowners in the sector. And, there are more than 12,000 dry bulk vessels and several thousand shipowners active in the market; once again, investment bankers in shipping should be voted happiest people on earth if consolidation was ever to take hold in this market segment.

Just like consolidation in shipping, the bigger, the better… or, the sky is the limit! Image credit: Karatzas Images

Onto a shipping sector with a more disciplined structure, the containership liner market, it would appear that consolidation has offered a proven solution to this market over time; from almost thirty liner companies in existence in the early 1990’s, the number now stands at fourteen (14), a clear trend of consolidation over the last two decades. Again, there does seem to be the same consolidation pattern of this market segment: most of these companies were big companies to begin with, often publicly listed or owned / managed by sophisticated investors in a market segment with relatively high barriers to enter; nothing new here. Looking onto smaller regional market players, the market has been much more fragmented, and allegedly ripe of consolidation. Some of these regional players are publicly listed or some of them run by investors and financiers, but it’s hard to discern a consolidation pattern on the surface. Probably the transactions that stand out in this sector are those of KG owners that are driven by shipping banks to consolidate, most notably MPC Container Ships, the Zeaborn and the Claus-Peter Offen groups that have keep absorbing smaller players such as Cido (containers), E.R. Schiffhart, Rickmers Linie, Ahrenkiel, Conti, etc (some of these transactions involved also MPP vessels). And, there has been the absorption of many more smaller KG houses and vessels that popped up in the last decade jus because of the exuberance of the KG market in Germany. What all these stories of consolidation have in common, in our opinion, is that most of these target companies had their financial base completely wiped out, the management teams had no ‘skin in the game’ but mostly, German shipping bank have effectively forced ‘shotgun marriages’ (read consolidation) in this market. Otherwise, left to its own devices, it’s questionable how much consolidation would had taken place in this segment.

Despite the obvious benefits in the shipping market by a less fragmented ownership distribution, with fewer and more stable players, it’s still a very long way, in our opinion, for the industry to really get to appreciate consolidation. It’s been vividly implied in the discussion above that each segment in the shipping industry is driven by slightly different factors, but it’s abundantly clear that consolidation so far has been driven by a confluence of financial owners (this includes shipping banks) building up on the critical mass of already sizeable companies and where egos can be forced aside by the prospects of economic benefits and payouts, often in the form of paper (shares).

For the several thousands of shipowners worldwide, especially when they are the founders of shipping companies or have some sort of competitive advantage (captive cargo, access to terminals, etc), consolidation would be a tall order. Consolidation favors bigger players, but still smaller players can be shaping the market for longer than hoped for.

Darwinism in known to work, but it takes a notoriously long time; economies of scale make for more efficient shipping companies, but again, this takes time. In Darwinism, let’s not forget, some species become extinct. Probably for some shipowners, unless extinction becomes their only choice, consolidation will be getting little attention. The financial markets and shipping finance can impose their will on shipping forcefully, but likely consolidation in the shipping industry cannot be material in the near future, at least for commodity shipping.

Article originally appeared in Lloyd’s List on September 7, 2018 under the heading “Consolidation Players Go Hungry“.

© 2013 – present Basil M Karatzas & Karatzas Marine Advisors & Co. All Rights Reserved.

IMPORTANT DISCLAIMER: Access to this blog signifies the reader’s irrevocable acceptance of this disclaimer. No part of this blog can be reproduced by any means and under any circumstances, whatsoever, in whole or in part, without proper attribution or the consent of the copyright and trademark holders of this website. Whilst every effort has been made to ensure that information here within has been received from sources believed to be reliable and such information is believed to be accurate at the time of publishing, no warranties or assurances whatsoever are made in reference to accuracy or completeness of said information, and no liability whatsoever will be accepted for taking or failing to take any action upon any information contained in any part of this website. Thank you for the consideration.

Basil M. Karatzas, Founder and CEO of Karatzas Marine Advisors & Co.

Basil M. Karatzas, Founder and CEO of Karatzas Marine Advisors & Co.